Group Private Medical Insurance.

-

Swift solutions for short-term hiccups!

Private Medical Insurance (PMI) has your team covered for short-term, fixable health issues, offering speedy treatment in a private clinic or hospital—with the consultant or specialist they trust most

-

Fast Tracked

Quick care, fast results! Your employees get speedy access to diagnosis and treatment when they need it most, so they’re back on their feet—and back to work—in no time.

-

More Choice & Control

Pick your place, perks, and pro! Standard policies cover the essentials—like surgery, consultations, nursing, and local hospital care. But if you’re after the VIP treatment, comprehensive policies take it up a notch with outpatient appointments and access to top private hospitals in central London

-

Get ahead of the game with faster access to the latest treatments and breakthrough meds, so your team can stay at the top of their health.

Your team gets the inside track on breakthrough drugs and treatments—sometimes even before they’re available on the NHS!

The Perks of PMI.

It’s often expected of larger corporations to have some sort of health plan included in employee benefits, but that doesn’t mean smaller businesses can’t employ those same benefits in their health and wellbeing policy. When weighing up your options, we’re here to support you in finding the best benefit plan that works for your business. Below are some key factors of general private medical insurance that can help your company move towards a happy and healthy business with minimal health disruption.

Treatment Access

Don’t leave your employees subject to long wait times, delaying their return to full health and their ability to rejoin the workforce. PMI means private care, granting them the speedy treatment they deserve.

Spreading Value

Having PMI demonstrates to your team that you’re committed to their wellbeing, therefore increasing job satisfaction and retention as your employees feel both recognised and valued.

Good Rep

By offering health insurance to your employees, it shows the market that you’re a caring and forward-thinking business. Not only does this bolster brand image but also attracts top industry talent.

Mental Health Matters

Mental health support is often included in PMI policies, this is an essential benefit in today’s workplace and demonstrates to your employees that you intend to look after both their physical and mental wellbeing.

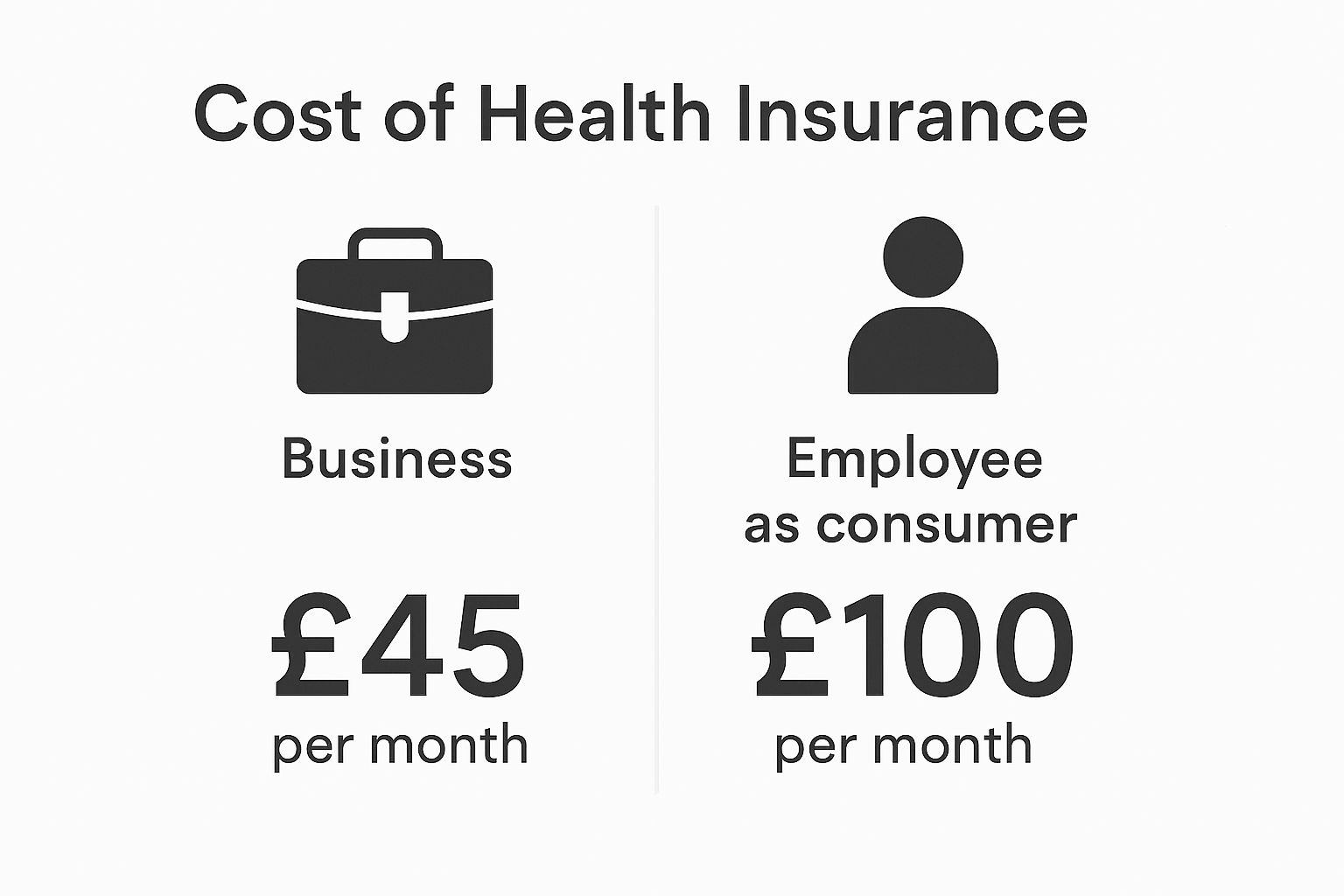

Health Insurance Cost Comparison: Employer-Funded vs. Individually Purchased

When it comes to health insurance, both businesses and employees are looking for value, flexibility, and peace of mind. But how do the costs and benefits compare between employer-funded and individually purchased health insurance?

Cost to Business (Employer-Funded)

Offering health insurance as an employee benefit can be a strategic investment for businesses. Here’s why:

Group rates reduce per-employee cost

Tax-deductible as a business expense

Enhances employee retention and wellbeing

P11D reporting for BIK

Employers can often negotiate better rates through group schemes and enjoy tax efficiencies that make this a cost-effective way to support staff wellbeing.

Cost to Employee (Individually Purchased)

When employees purchase health insurance independently, they often face:

Higher monthly premiums

Limited coverage options

No employer contribution

No tax relief unless self-employed

Without the buying power of a group or employer support, individuals may pay more for less comprehensive coverage.

Disclaimer: The figures presented are for illustrative purposes only and are intended to demonstrate the potential differences in cost between company-funded and individually purchased health insurance. Actual pricing will vary based on factors such as age, group size, location, underwriting terms, and the specific product selected.

Healthy Staff, Stronger Business: Why Employee Wellbeing Matters

Discover how investing in employee health can significantly reduce absenteeism, boost productivity, and help your organisation attract and retain top talent. In this video, we explore the business benefits of a healthy workforce and how workplace wellbeing strategies—like private medical insurance, mental health support, and preventative care—can drive performance and employee satisfaction.

Lower staff absence

Higher productivity

Improved employee retention

Enhanced employer brand

Learn how prioritising health at work isn’t just good for your people—it’s smart for business.

Understanding the Basics of Private Medical Insurance.

-

Your health insurance generally won't cover the long-term treatment of chronic conditions—these are illnesses or injuries that require ongoing management. Some examples include asthma, osteoporosis, and conditions that:

Need regular check-ups, tests, or monitoring

Require long-term control of symptoms

Are ongoing or tend to return

Can’t be cured

However, acute flare-ups or sudden episodes of chronic conditions may be covered. Always check your policy for details!

-

Private hospitals don’t handle emergencies. In case of urgent treatment, head to the nearest A&E department. Once you're stable, your private health insurance can help cover the cost of moving to a private hospital or even a private ambulance (if included in your policy).

-

Generally, pregnancy and childbirth aren’t covered. However, complications that arise during pregnancy or childbirth might be.

-

Insurance typically pays directly to the hospital for treatment and stays. Outpatient care may be fully covered or limited, and if there's a shortfall, you'll need to cover the difference depending on your policy.

-

You can choose to cover just yourself or add your partner and/or children to the policy. Different insurers offer varying coverage options, so be sure to explore what's available for your family.

-

Private hospitals work with multiple insurers but are independent. Hospital lists matter, especially if you're considering London hospitals, as their fees are higher than in other areas. Always review your options!

-

An excess can help control costs and reduce claims. This can encourage employees to carefully consider when to use their health insurance, which can keep premiums lower in the future.

-

Underwriting determines what your policy covers. The most common approach, moratorium underwriting, doesn’t require a medical questionnaire but has a 5-year look-back period for pre-existing conditions. After 2 years of continuous coverage, you could be covered for past conditions.

-

When changing insurers, it’s vital to ensure your underwriting is transferred, so you don’t lose coverage for any pre-existing conditions.

The Important Stuff.

-

It’s crucial to understand the requirements of your workforce as PMI doesn’t typically cover pre-existing health issues. The plan is designed to address the onset of acute conditions rather than chronic illnesses such as diabetes or arthritis which are usually managed by the NHS.

-

The premium you pay for your PMI depends upon factors like employee age, the level of coverage and any extras you may opt-in for, such as mental health or dental care. Whilst all healthcare benefits are an investment into your workforce, the costs of such need to align with your budget so your business is still able to thrive.

-

Procedures such as cosmetic surgery, treatments, or routine checkups that aren’t medically necessary are usually excluded from private health insurance policies unless these are written into the product for you.

-

Whilst PMI is a favourable route to quicker treatment, employees may still rely on the NHS for emergency care as well as other services not included in your PMI plan. It’s important to note that private health benefits offered by your organisation are not a replacement for the NHS.